Year |

Budget |

Capital Projections |

Reserve Projections |

| 2025 | 2025 Budget | 2025 Capital Projections | 2025 Reserve Projections |

| 2024 | 2024 Budget | 2024 Capital Projections | 2024 Reserve Projections |

| 2023 | 2023 Budget | 2023 Capital Projections | 2023 Reserve Projections |

Financial Information

The municipal budget is a policy and planning document that outlines our Municipality's priorities and is a balancing act between what we can afford and providing a high level of service to residents.

Each year, Municipal staff prepares a preliminary budget for Council's consideration, with input from Northern Bruce Peninsula residents, so that decisions can be made on the services and programs that will be offered in that year.

Municipal Budget Overview

Reserves and reserve funds receive annual contributions from the operating budget to assist with creating a solid financial position to support the Municipality's future cash requirements. Maintaining sufficient balances in reserves and reserve funds is a critical component of a municipality's long-term financial plan as it reinforces its long-term financial sustainability, helps to minimize variations in the tax rate and provides funding to sustain infrastructure.

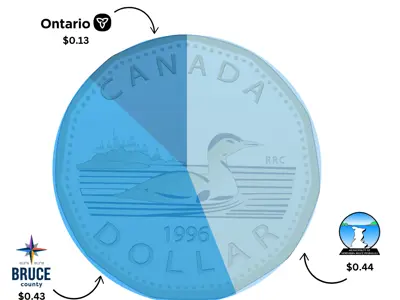

Allocation of Taxes

- Northern Bruce Peninsula – 44%

- County of Bruce – 43%

- Province of Ontario – 13%

Municipal Services and the Budget Process

In the Municipality of Northern Bruce Peninsula, we are the community's trusted provider of essential services such as fire protection, by-law enforcement, snow removal, and waste management—ensuring that daily life runs smoothly and safely.

Our committed Council establishes strategic priorities to consistently serve the community's best interests. With a carefully crafted budget in place, we are prepared to transform these priorities into actionable steps, making the Municipality an even better place to live.

Additional Resources

Financial Statements & Year End Reports

Year |

Financial Statement |

Year End Auditor Report |

| 2021 | 2021 Financial Statements | 2021 Auditor Year End Report |

| 2022 | 2022 Financial Statements | 2022 Auditor Year End Report |

For information regarding property assessments and taxes, please click here!

Frequently Asked Questions

The Operating budget covers the daily expenses that the municipality incurs to provide programs and services to residents. It includes costs such as materials and supplies, general maintenance, and salaries.

The Capital budget addresses the municipality’s major capital assets and infrastructure. It covers the acquisition, rehabilitation, and replacement of assets such as bridges, machinery, buildings, and roads.

How are capital projects prioritized?

Council establishes priorities using tools such as the Strategic Plan, the Asset Management Plan, the Road and Sidewalk Needs Study, and the Parks and Recreation Master Plan to guide the budget process.

How much of the operating budget comes from taxes?

In 2024, the total budgeted operating expenses were $13,560,871. The total tax levy required (amount billed to taxpayers) was $5,264,945.

The difference is offset by grants, user fees (excluding water and wastewater), and other revenue sources.

How does the budget affect my property taxes?

The budget includes the anticipated costs for the Municipality to provide services for the year. Revenue sources such as user fees and grants are applied to those expenses. The balance is billed to the property owners based on their assessment.

What makes up the Bruce County portion of my tax bill?

The County of Bruce is our upper tier Municipality. The County is responsible for services such as childcare, long-term care homes, ambulance and paramedic, county road maintenance, economic development, and land use planning. The County goes through a budget process and establishes the amount required from taxpayers. This County-wide tax rate is applied to all Bruce County taxpayers according to their assessment. The lower-tier municipalities collect and remit this amount to the province.

What makes up the Education portion of my tax bill?

The Province of Ontario is responsible for the public education system. The province levies a rate applicable to all residential taxpayers throughout the province. This rate is applied to your assessment to calculate the amount you will pay for education. The municipality collects and remits this amount to the province.

The education amount for Commercial and Industrial properties is based on different formulas calculated by the province.

How are water and wastewater expenses paid for?

The expenses for the Lion’s Head Water System, the Lakewood Sewer System, and the Tobermory Sewer System are paid by the users of these systems. Any funds budgeted for these utilities can only be used for that purpose.

Contact Us

Municipality of Northern Bruce Peninsula

56 Lindsay Road 5

Lion’s Head ON N0H 1W0

1-833-793-3537

Email Us