|

Year |

Budget |

Capital Projections |

Reserve Projections |

| 2025 | 2025 Budget | 2025 Capital Projections | 2025 Reserve Projections |

| 2024 | 2024 Budget | 2024 Capital Projections | 2024 Reserve Projections |

Municipal Budget

Budget Factors and Guidelines

Municipal spending is guided by community needs, service demand, and the ability of residents and businesses to fund these services. Aging infrastructure requires ongoing maintenance and renewal, while the Municipality strives to ensure programs, services, and facilities remain sustainable.

Key factors influencing the annual budget include inflation, population and development growth, economic trends, market conditions, taxation, and Council policy decisions.

Key Dates and Resources

Budget Process

The 2026 Municipal Budget process is underway and reflects several months of planning. The Municipality of Northern Bruce Peninsula delivers essential services such as fire protection, by-law enforcement, snow removal, and waste management to support a safe and well-functioning community.

Guided by Council’s strategic priorities, the budget translates community needs into action while ensuring prudent fiscal planning and the long-term economic sustainability of the Municipality.

2026 Key Dates

| Date | Action |

|---|---|

| January 26,2026 at 9:00 am | Capital Budget |

| February 9th, 2026 at 9:00 am | Operating Budget |

| February 23rd, 2026 at 1:00 pm | Review Second Draft of Budget |

| March 9th, 2026 at 1:00 pm | Public Presentation and Anticipated Adoption |

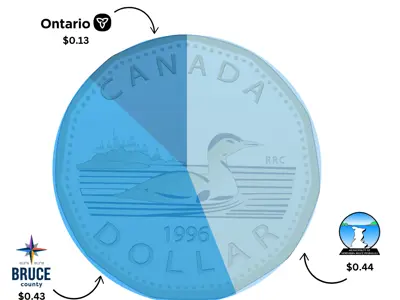

Allocation of Taxes (2025)

- Northern Bruce Peninsula – 44%

- County of Bruce – 43%

- Province of Ontario – 13%

Operating and Capital Budget Reports

Understanding Your Municipal Budget

Budget Guide Coming Soon!

For information regarding property assessments and taxes, please click here!

Contact Us

Municipality of Northern Bruce Peninsula

56 Lindsay Road 5

Lion’s Head ON N0H 1W0

1-833-793-3537

Email Us